Israel E-Invoicing (SAP ByD – ITA)

Challenges/Requirement

The Israeli Tax Authority has announced that electronic invoicing will become mandatory in Israel from 5th May 2024 and that all B2B VAT-registered invoices above 25000 NIS must be submitted to the Israeli government.

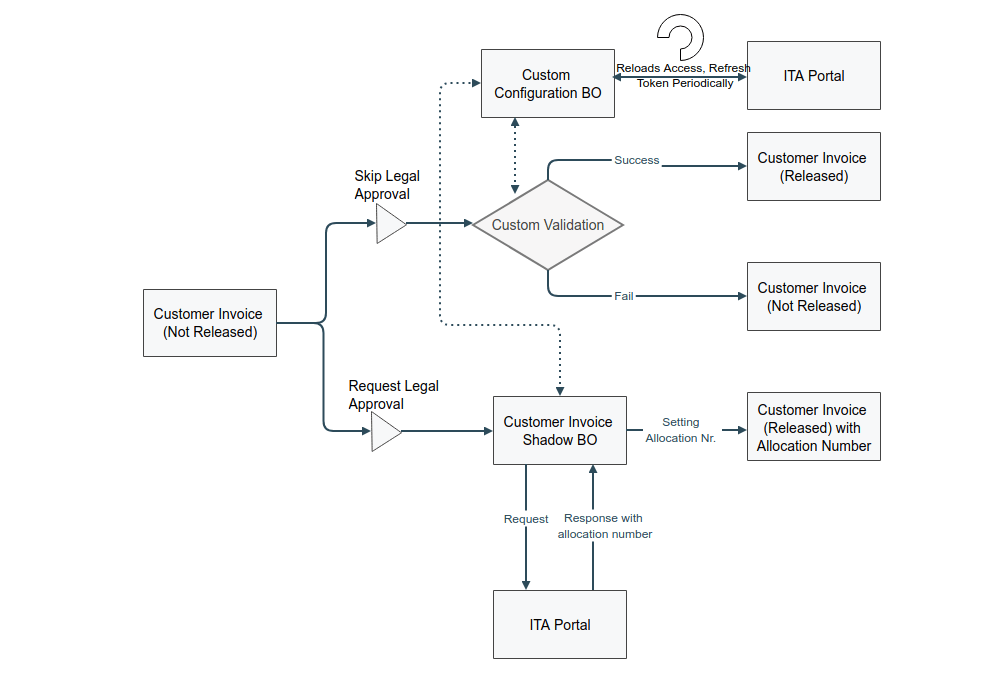

The e-invoicing integration will submit the Invoice details to the Tax Authority greater than the threshold amount(25000 NIS) and store the allocation number received for the submitted invoice. SAP has released a set of standard legal approval actions for the ByD system, which include Start, Skip, and Withdraw Legal Approval. Once an invoice is posted in the ByD system, users must click the Start Legal Approval button to submit the invoice to the Tax Authority. For invoices below the threshold amount, users have the option to choose Skip Legal Approval. The submitted invoices can be found in the Israeli Tax Authority e-Invoicing Portal.

Technical Solution

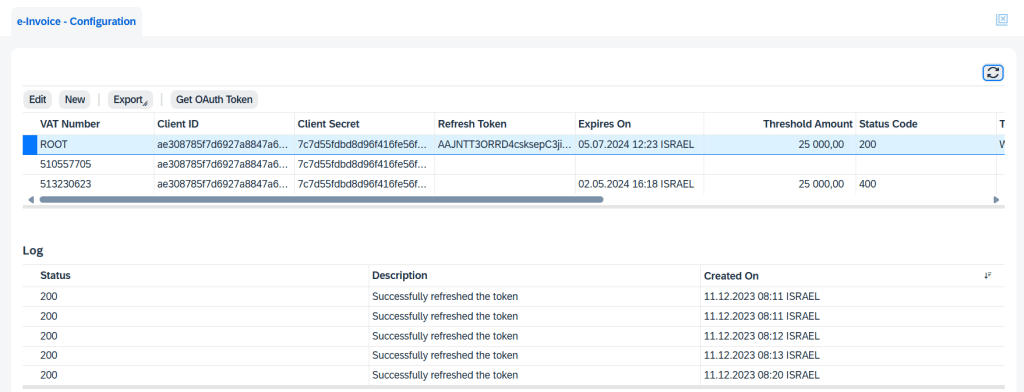

We’ve developed a configuration screen to save Authorization Tokens for accessing the ITA, setting the Threshold Amount for the Invoices, and specifying the company’s product category on a company basis. This configuration screen also has a scheduler job to refresh the tokens every 3 hours. As per the ITA’s guidelines, the refresh tokens will only have a lifespan of 90 days. So, after 90 days, the users/employees need to request a new refresh token from the ITA portal.

Seller’s Perspective

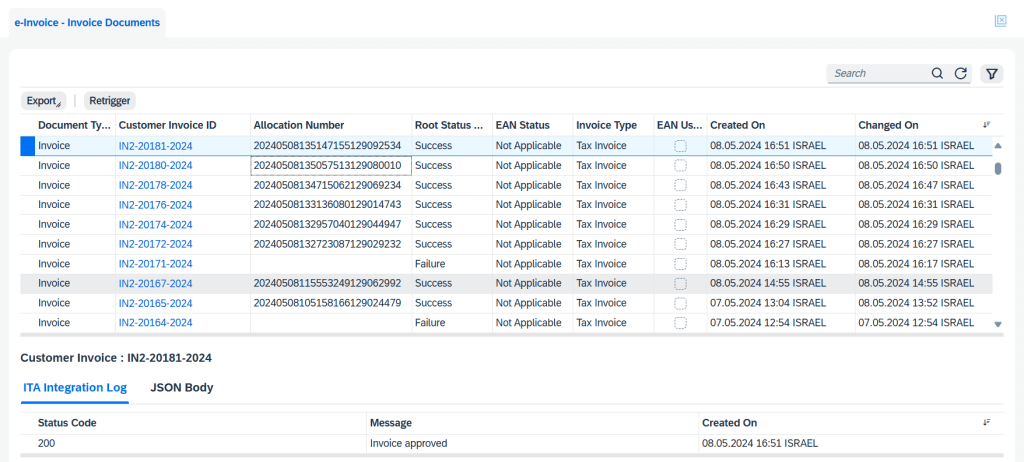

When the user clicks Start Legal Approval, we will use the Invoice Approval Restful API provided by the ITA to send the necessary invoice details and store the returned allocation number against the invoice in ByD. Once the Allocation Number is stored in the Invoice Document, the user needs to click on the “Notify Legal Approval” button. This action will change the Legal Approval Status to “Approved” and release the Invoice. If the Allocation Number is not returned from the API Call, the reason can be found in the logs of the Custom Invoice Documents screen. We have also implemented validation to prevent skipping legal approval for invoices with amounts that exceed the specified threshold amount on the configuration screen if the user clicks Skip Legal Approval. Users can only skip legal approval for invoices below the threshold amount.

Buyer’s Perspective

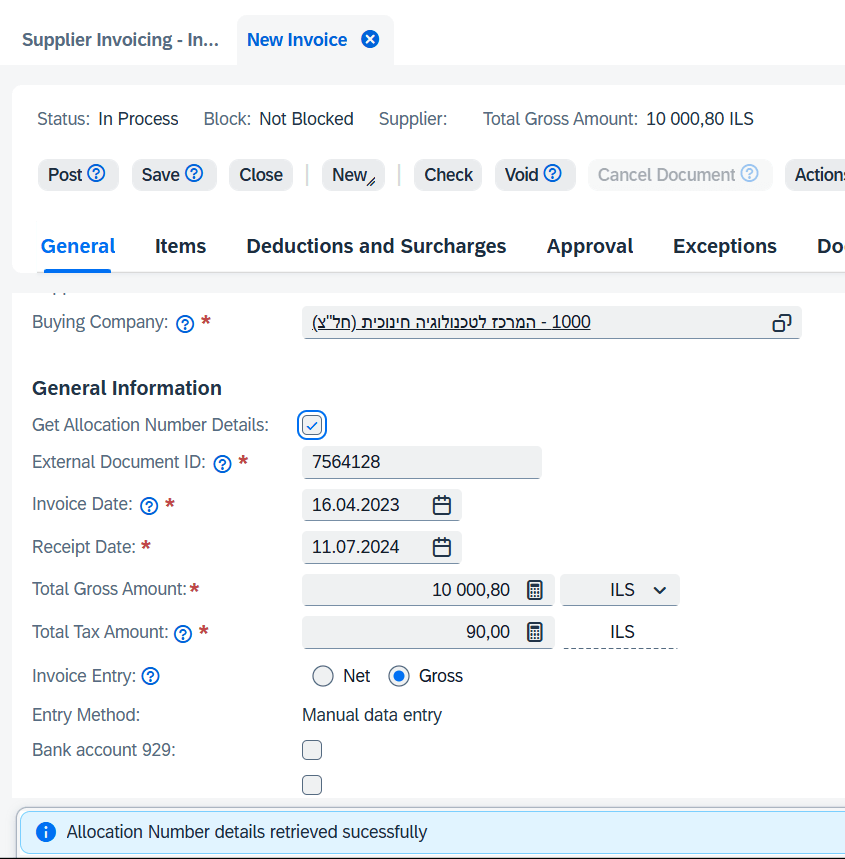

The buyer will receive an allocation number on the invoice copy from the seller. To verify the details on the invoice, the buyer can access the Supplier Invoice work center in ByD. After entering the allocation number, the buyer can retrieve the invoice details submitted by the seller using the Invoice Information Retrieval Restful API provided by the ITA. If the allocation number is valid, a successful validation message will be returned to the supplier; otherwise, a warning message will be displayed.

Business Benefits

- Sellers can easily submit invoice details such as Net and Tax Amounts, the products or services sold, and the buyer’s and seller’s information automatically to Israel Tax Authority

- Buyers can validate the invoice details on their end using the assigned allocation number for the invoice. This system promotes transparency among the seller, buyer, and the government

- No manual human efforts are needed to create invoices on the ITA Portal.