Upload of Bank Payment Advice

Business Need

In situations where a large volume of payment advices must be uploaded, the standard approach of creating each payment advice individually becomes highly time-consuming and labor-intensive. Users require a more efficient and user-friendly solution to streamline this process and reduce the manual workload.

Proposed Solution

We recommended an Excel upload solution for efficiently uploading Bank Payment Advices into SAP Business ByDesign. Users can input payment advice details in Excel, and with just one click, the advices are processed swiftly, even those with multiple line items. This approach leverages users’ familiarity with Excel, ensuring a simple and cost-effective implementation. Additionally, after the upload, the system automatically clears the AR invoice items.

Technical Highlights

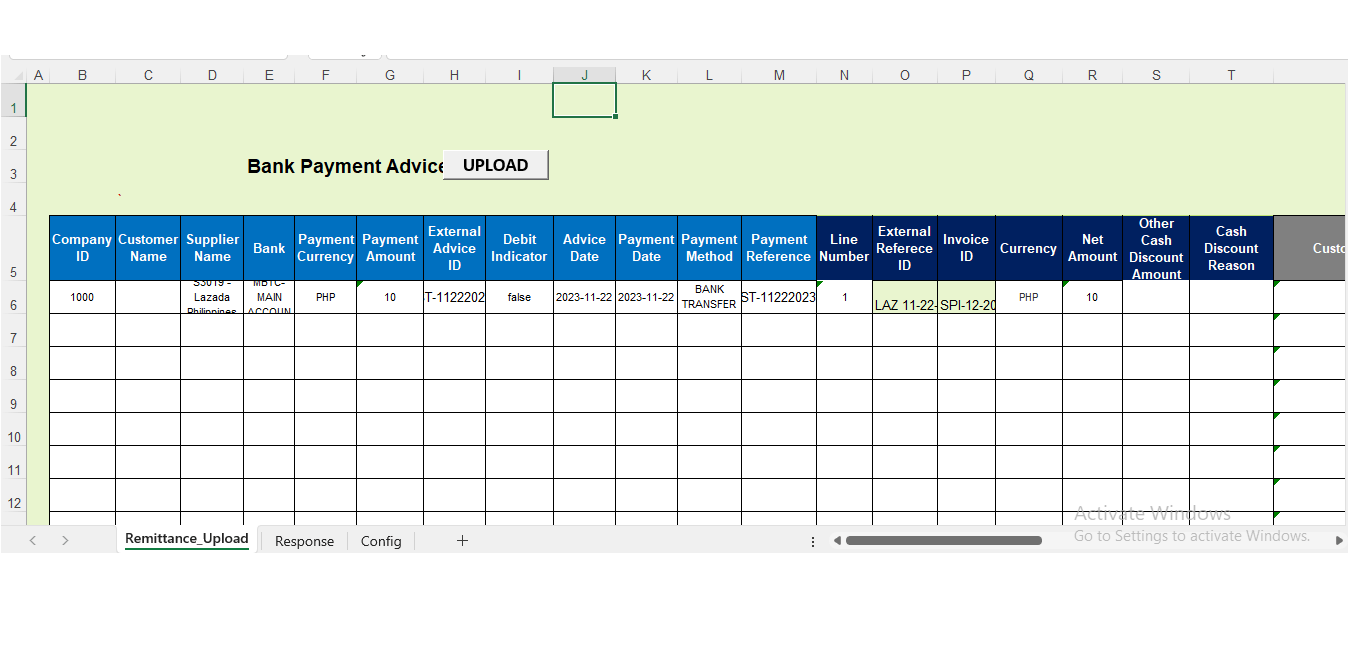

Users enter the payment advice header and item details into an Excel sheet. Once the details are completed, a VBA script is triggered with a button click, sending the Bank Payment Advice data from Excel to SAP Business ByDesign using the ManageBankAdviceIn web service. The payment advice details are converted to XML format within Excel and then processed by SAP ByDesign through the ManageBankAdviceIn web service. The response logs from SAP ByDesign are captured in the Excel Upload file’s Response tab.

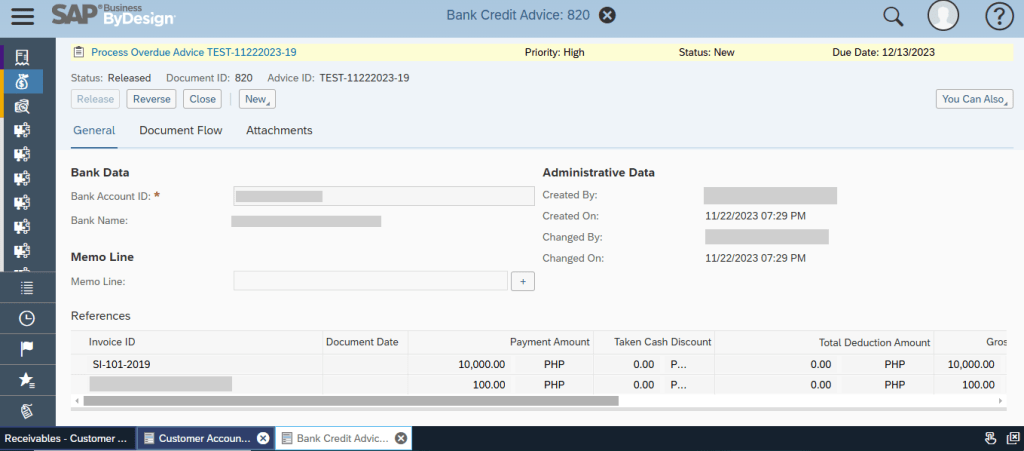

In the response sheet, the ID is captured, and the bank payment advice can be created in the UI.

After creating the Bank Payment Advice without errors, the status of the trade receivables for incoming payments will be automatically updated to either ‘Partially Cleared’ or ‘Cleared.

Business Benefits

- Bulk Processing Efficiency

Leveraging Excel for batch uploads enables the simultaneous processing of multiple payment advices, drastically reducing the time and manual effort required to handle large volumes of transactions.

- Significant Time Savings

Automating the payment upload process not only accelerates the workflow but also allows finance teams to allocate more time to strategic, value-driven tasks rather than repetitive data entry.

- Enhanced Accuracy

By minimizing manual input, the solution reduces the likelihood of errors, ensuring more reliable and accurate payment processing.

- User-Friendly Implementation

The familiarity of Excel ensures that users can easily adopt the solution with minimal training, leading to faster implementation and quicker realization of benefits.